Welcome to OY! API Documentation. Our API services are organized around REST, accepts form-encoded request bodies and returns JSON-encoded responses.

For the purpose of standardization and to prevent any misunderstanding, below our the terms we are going to use in this documentation:

After partner has acquired access to OY! API Services, then:

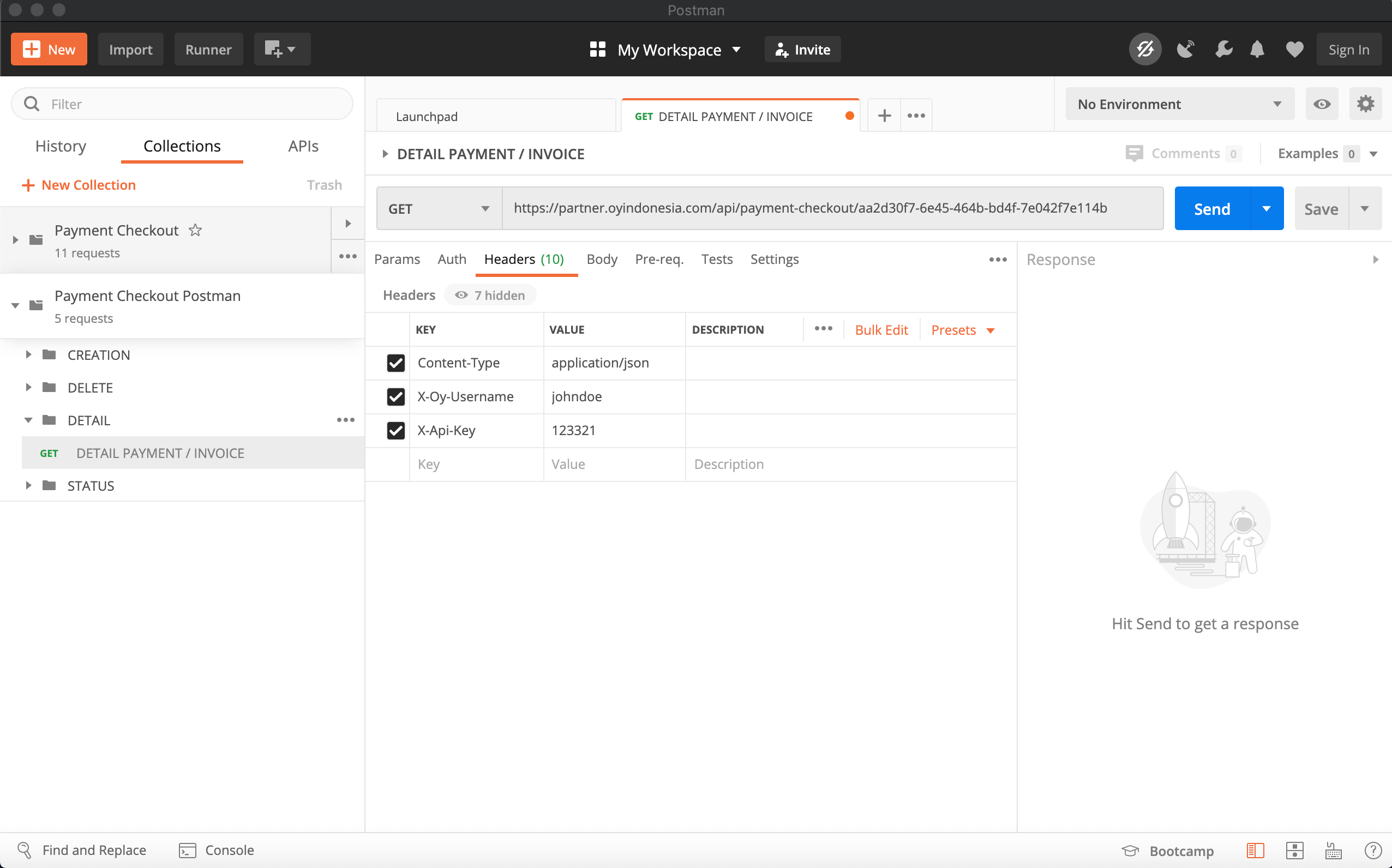

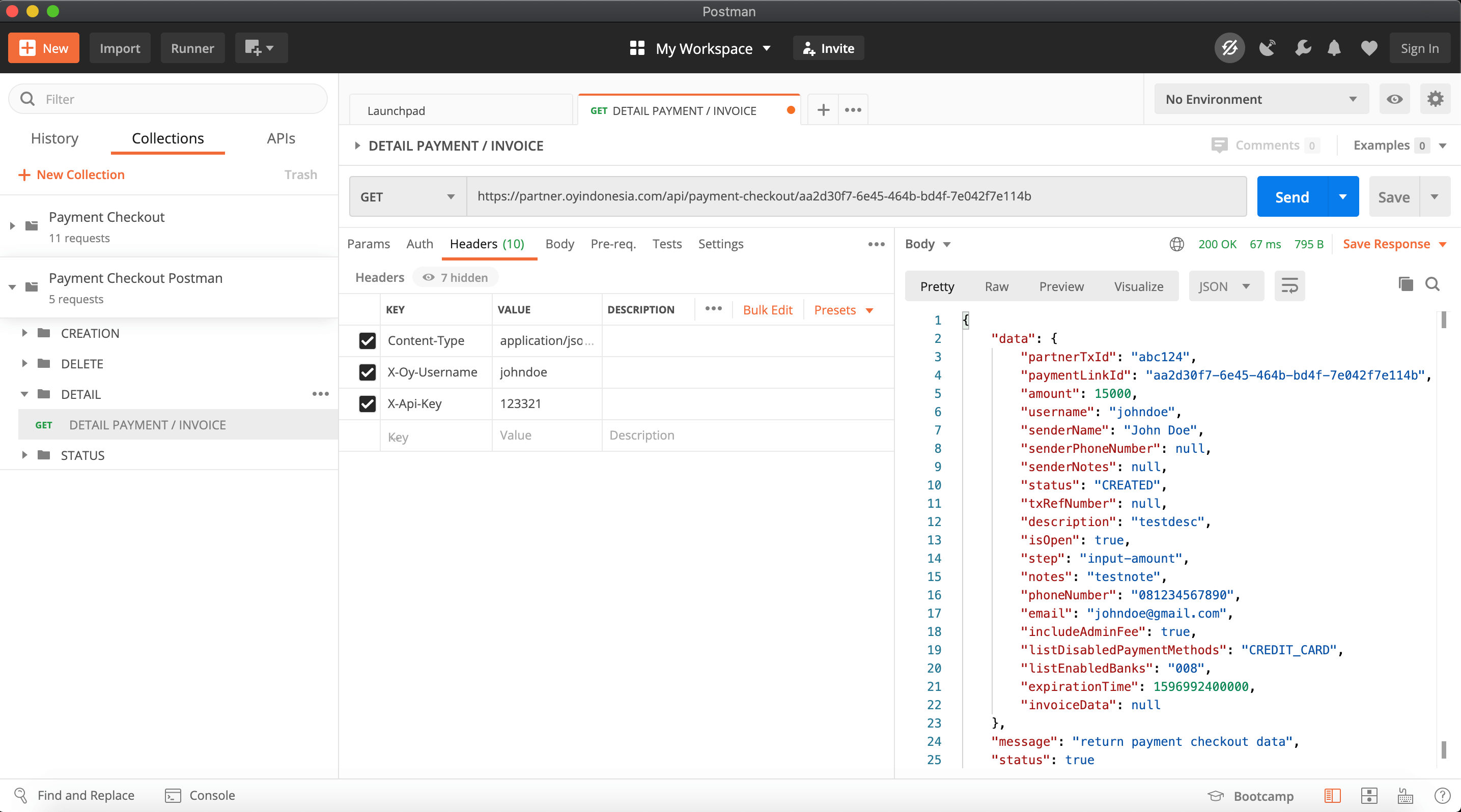

Postman is a free web testing service that provides an easy, fast, and solid software for developers to learn and maintain a web service contract from both the provider and consumer. As such, Postman has become a widely used tool for contract testing and reference due to its User Experience.

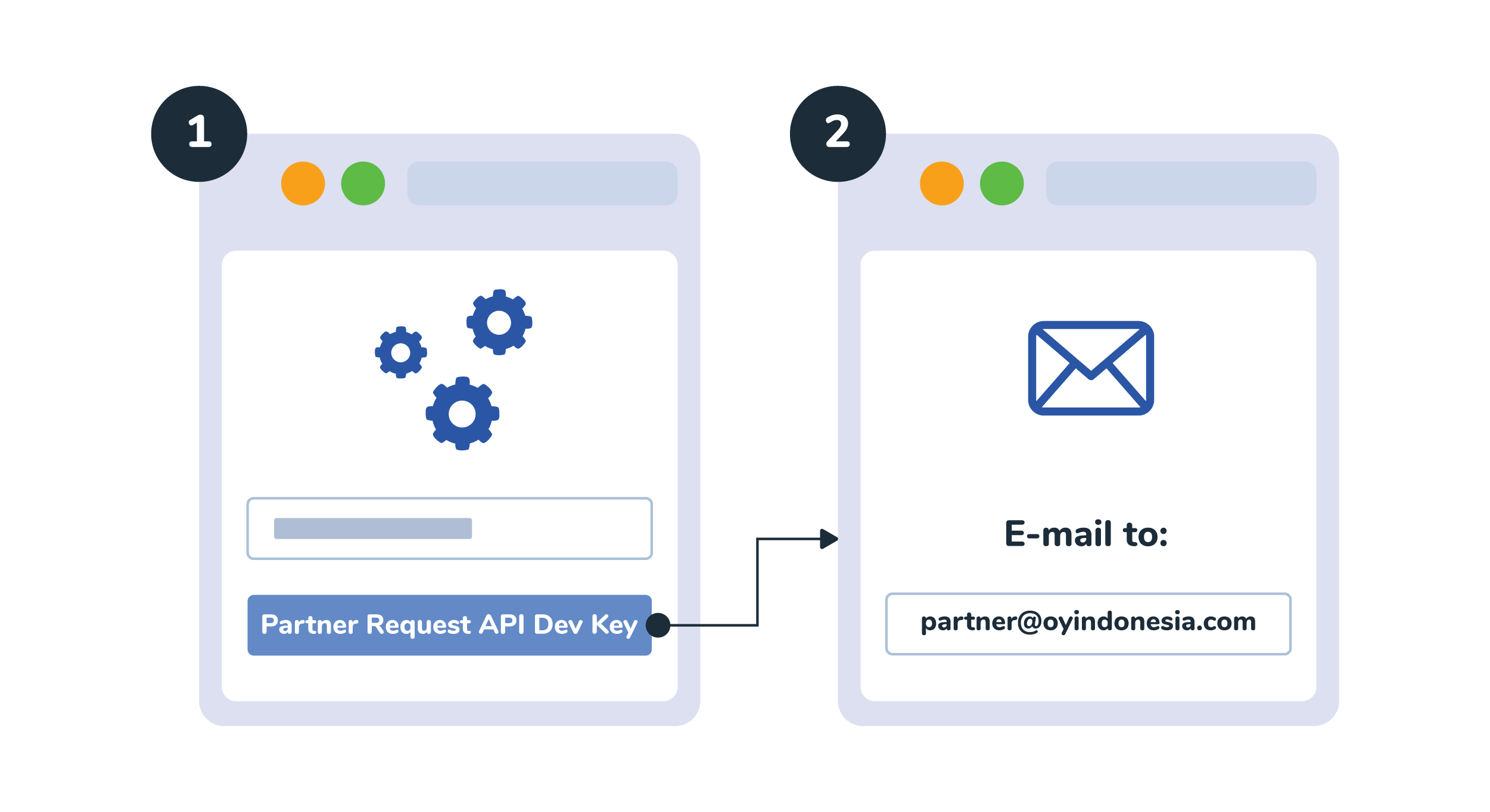

Prerequisites: You must have received an authorization Username and API Key from us to access our feature. Contact us at partner@oyindonesia.com to receive your authorization information now.

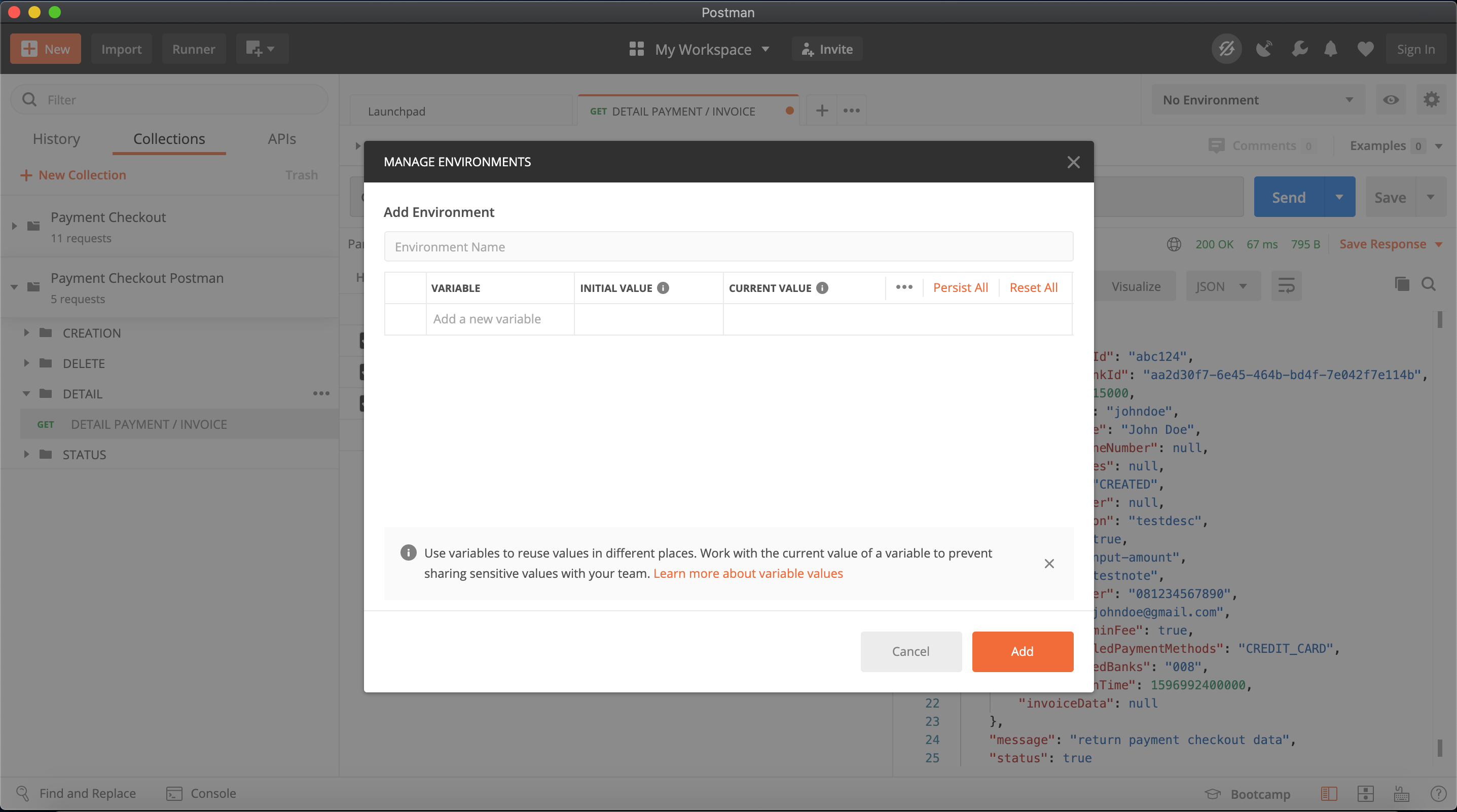

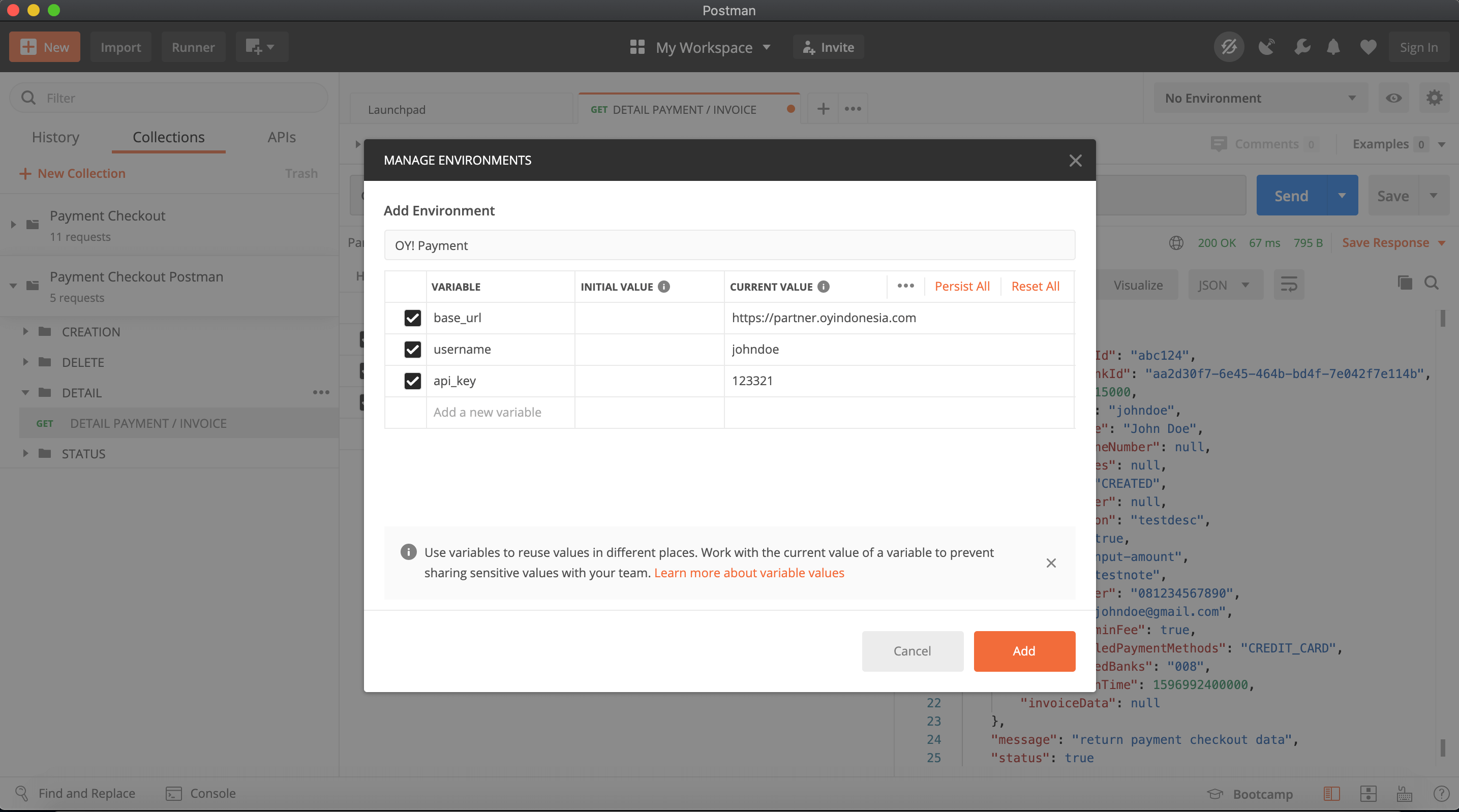

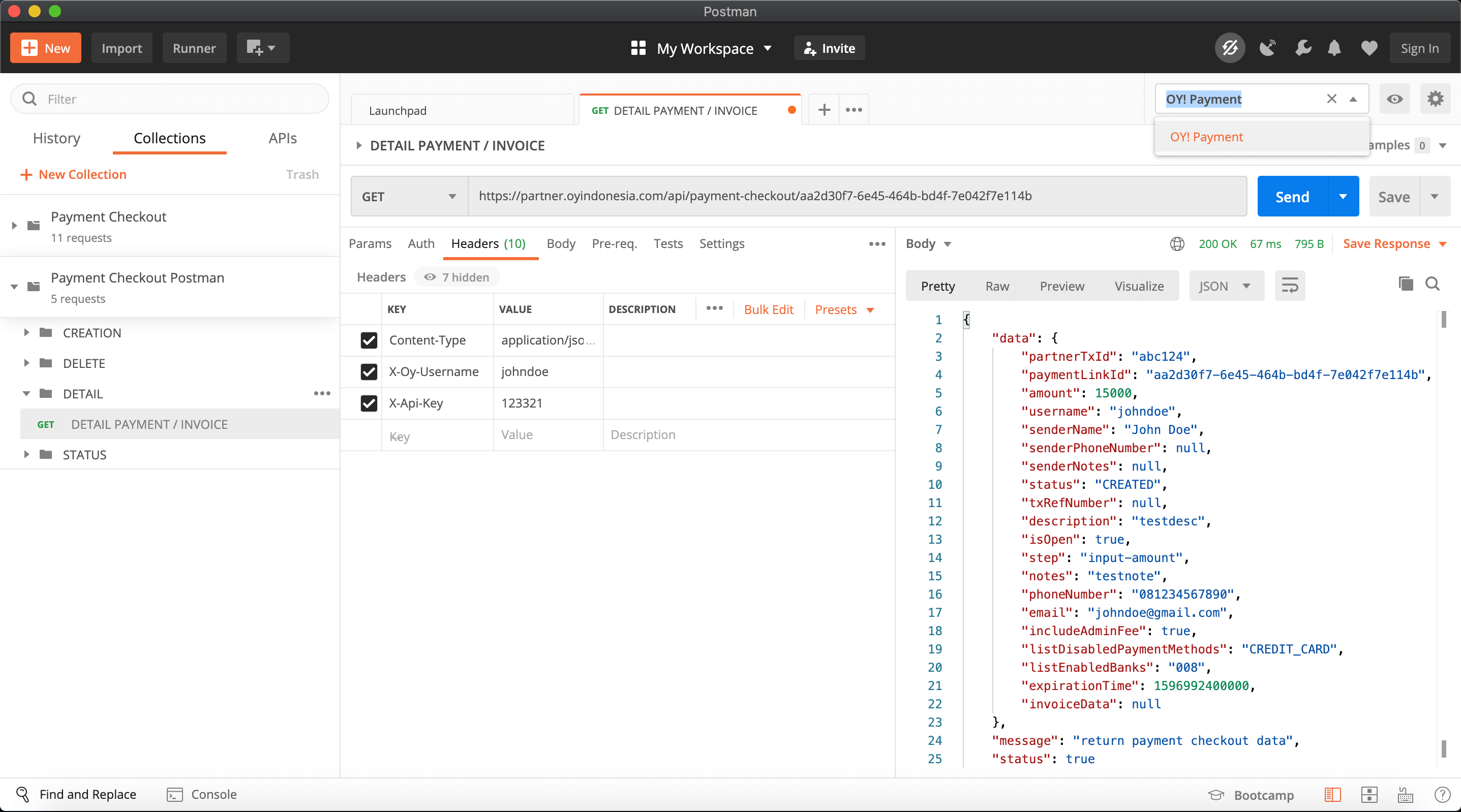

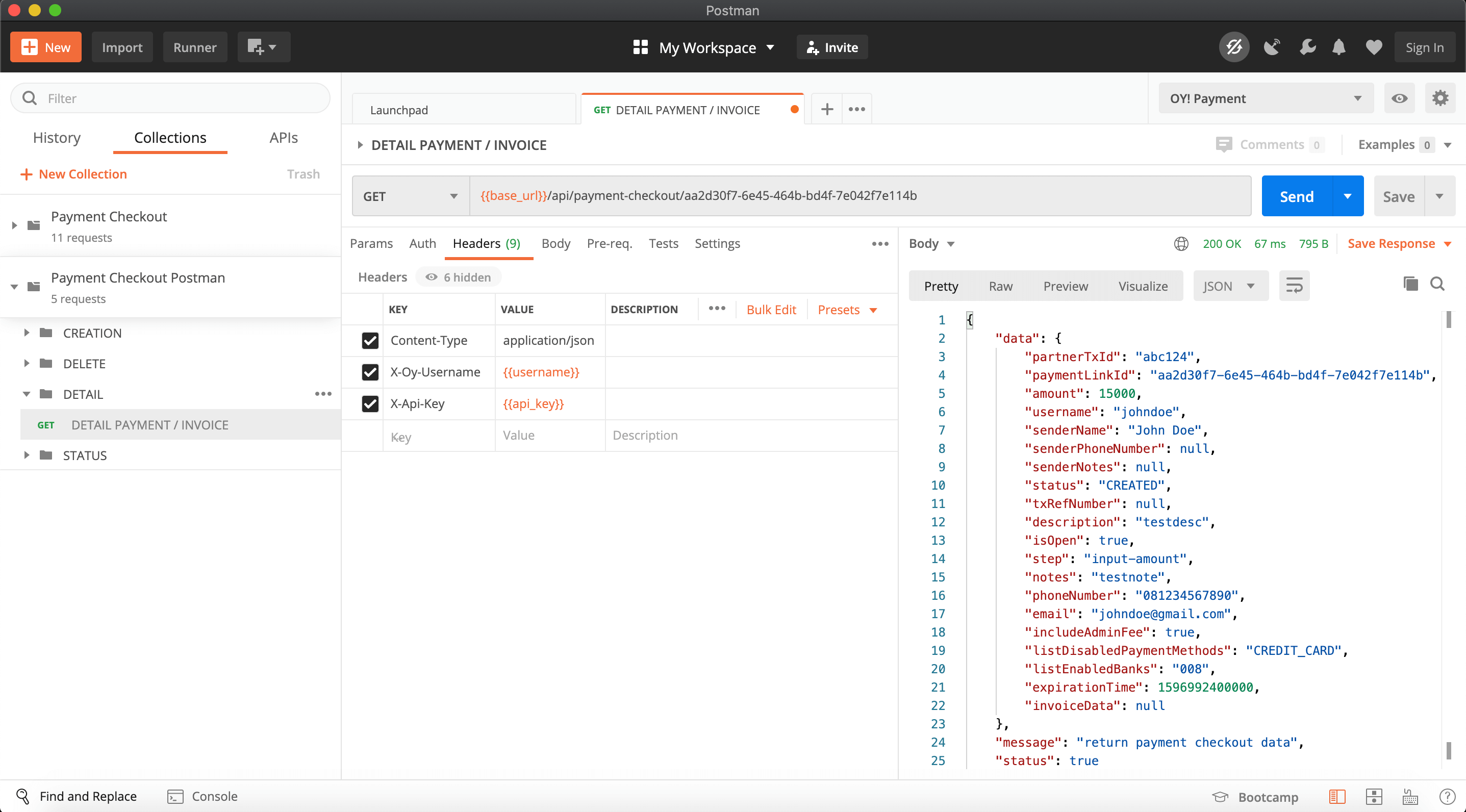

The Postman Variable Environment provides you with the capabilities to save authorization configurations. You can use these saved configurations for all your Postman Requests. This step is optional.

You just set your authorization value header with environment variable which already configured.

If you were able to complete all these steps, your environment is working perfectly and is on the right track. Feel free to test out our other API products or contact us at partner@oyindonesia.com if you encountered any difficulties testing our Postman Collection.

OY! API uses pair of API Key and IP Address to authenticate a partner request. Partner needs to register a unique IP Address which will be used as originating request for the API Services.

Disbursement API can be requested through HTTPS Request to OY! API Base URL endpoint. The HTTPS Header has to be used to allow proper authentication, additionally HTTPS Request should only be made from IP Address which has been registered in OY! System.

Production Environment: https://partner.oyindonesia.com

Use following HTTPS Headers when you make a call to OY! API

| Header | Type | Description |

|---|---|---|

| Content-Type | application/json | The Content-Type field indicates that JSON type is acceptable to send to the recipient |

| Accept | application/json | The Accept field is used to specify that JSON type is acceptable for the response |

| X-OY-Username | String(64) | Partner Username to access OY! API services |

| X-Api-Key | String(255) | Partner API Key to access OY! API services |

Account Inquiry APIs allow you to get beneficiary account details.

Invoice will be created on the first API hit of the day with status INITIATED. The next day, invoice will be updated with status UNPAID. The inquiry service can still be used if there are UNPAID invoices within the agreed grace period.

A scheduler will run every day to check if there is UNPAID invoice that needs to be paid to prevent the inquiry service to be blocked by our system and the invoice status will be updated to PAID. In the event that there is insufficient balance when the scheduler runs, it is the partner responsibility to ensure the invoice is paid accordingly via the payment endpoint or the business portal.

curl -X \

POST https://partner.oyindonesia.com/api/account-inquiry \

-H 'content-type: application/json' \

-H 'accept: application/json' \

-H 'x-oy-username:myuser' \

-H 'x-api-key:987654' \

-d '{

"bank_code": "014",

"account_number": "1239812390"

}'

var headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-oy-username': '{{username}}',

'x-api-key': '{{api-key}}'

};

var request = http.Request('POST', Uri.parse('{{base_url}}/api/account-inquiry'));

request.body = json.encode({

"bank_code": "014",

"account_number": "1280259361"

});

request.headers.addAll(headers);

http.StreamedResponse response = await request.send();

if (response.statusCode == 200) {

print(await response.stream.bytesToString());

}

else {

print(response.reasonPhrase);

}

package main

import (

"fmt"

"strings"

"net/http"

"io/ioutil"

)

func main() {

url := "%7B%7Bbase_url%7D%7D/api/account-inquiry"

method := "POST"

payload := strings.NewReader(`{

"bank_code": "014",

"account_number": "1280259361"

}`)

client := &http.Client {

}

req, err := http.NewRequest(method, url, payload)

if err != nil {

fmt.Println(err)

return

}

req.Header.Add("Content-Type", "application/json")

req.Header.Add("Accept", "application/json")

req.Header.Add("x-oy-username", "{{username}}")

req.Header.Add("x-api-key", "{{api-key}}")

res, err := client.Do(req)

if err != nil {

fmt.Println(err)

return

}

defer res.Body.Close()

body, err := ioutil.ReadAll(res.Body)

if err != nil {

fmt.Println(err)

return

}

fmt.Println(string(body))

}

OkHttpClient client = new OkHttpClient().newBuilder()

.build();

MediaType mediaType = MediaType.parse("application/json");

RequestBody body = RequestBody.create(mediaType, "{\n \"bank_code\": \"014\",\n \"account_number\": \"1280259361\"\n}");

Request request = new Request.Builder()

.url("{{base_url}}/api/account-inquiry")

.method("POST", body)

.addHeader("Content-Type", "application/json")

.addHeader("Accept", "application/json")

.addHeader("x-oy-username", "{{username}}")

.addHeader("x-api-key", "{{api-key}}")

.build();

Response response = client.newCall(request).execute();

var data = JSON.stringify({

"bank_code": "014",

"account_number": "1280259361"

});

var xhr = new XMLHttpRequest();

xhr.withCredentials = true;

xhr.addEventListener("readystatechange", function() {

if(this.readyState === 4) {

console.log(this.responseText);

}

});

xhr.open("POST", "%7B%7Bbase_url%7D%7D/api/account-inquiry");

xhr.setRequestHeader("Content-Type", "application/json");

xhr.setRequestHeader("Accept", "application/json");

xhr.setRequestHeader("x-oy-username", "{{username}}");

xhr.setRequestHeader("x-api-key", "{{api-key}}");

xhr.send(data);

<?php

require_once 'HTTP/Request2.php';

$request = new HTTP_Request2();

$request->setUrl('{{base_url}}/api/account-inquiry');

$request->setMethod(HTTP_Request2::METHOD_POST);

$request->setConfig(array(

'follow_redirects' => TRUE

));

$request->setHeader(array(

'Content-Type' => 'application/json',

'Accept' => 'application/json',

'x-oy-username' => '{{username}}',

'x-api-key' => '{{api-key}}'

));

$request->setBody('{\n "bank_code": "014",\n "account_number": "1280259361"\n}');

try {

$response = $request->send();

if ($response->getStatus() == 200) {

echo $response->getBody();

}

else {

echo 'Unexpected HTTP status: ' . $response->getStatus() . ' ' .

$response->getReasonPhrase();

}

}

catch(HTTP_Request2_Exception $e) {

echo 'Error: ' . $e->getMessage();

}

import http.client

import json

conn = http.client.HTTPSConnection("{{base_url}}")

payload = json.dumps({

"bank_code": "014",

"account_number": "1280259361"

})

headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-oy-username': '{{username}}',

'x-api-key': '{{api-key}}'

}

conn.request("POST", "/api/account-inquiry", payload, headers)

res = conn.getresponse()

data = res.read()

print(data.decode("utf-8"))

The above command returns JSON structured similar like this:

{

"status": {

"code": "000",

"message": "Success"

},

"bank_code": "014",

"account_number": "1239812390",

"account_name": "John Doe",

"timestamp": "2020-11-19T17:01:17",

"id": "59e11245-4b36-4ed7-97be-0c501b8ae3c8",

"invoice_id": "c0503fa6-a5b3-4816-bc07-241473357f58"

}

Use this API to get beneficiary account details.

[Production] POST https://partner.oyindonesia.com/api/account-inquiry

[Staging] POST https://api-stg.oyindonesia.com/api/account-inquiry

| Parameter | Type | Required | Description |

|---|---|---|---|

| bank_code | String(255) | TRUE | Bank Code of the Beneficiary account, see Disbursement Bank Codes |

| account_number | String(255) | TRUE | Beneficiary account number, numeric only |

| Parameter | Type | Description |

|---|---|---|

| status | Object | Status of inquiry {code: <status_code>, message: <status_message>} |

| bank_code | String | Bank Code of the Beneficiary account, see Disbursement Bank Codes |

| account_number | String | Account Number of the Beneficiary Account |

| account_name | String | Account Name of the Beneficiary Account |

| id | String | Unique ID of the inquiry. ID will be provided only for 000 or 209 status. Otherwise, the ID will be null. |

| invoice_id | String | ID of the invoice related to the inquiry result. |

| timestamp | Timestamp | UTC Timestamp api hit (Format: yyyy-MM-ddTHH:mm:ss) |

curl -X \

GET https://partner.oyindonesia.com/api/account-inquiry/invoices \

-H 'content-type: application/json' \

-H 'accept: application/json' \

-H 'x-oy-username:myuser' \

-H 'x-api-key:987654'

The above command returns JSON structured similar like this:

{

"total": 3,

"status": {

"code": "000",

"message": "Success"

},

"timestamp": "2020-12-03T17:01:17",

"data": [

{

"invoice_id": "e972bfcb-fcc4-4732-8887-91a589a0b54a",

"tx_date": "2020-12-03",

"amount": 2000.0000,

"total_inquiry": 2,

"paid_at": null,

"invoice_status": "INITIATED",

"due_at": "2020-12-04T16:59:59"

}, {

"invoice_id": "53f48b8a-1f53-4f56-aa91-7b32414a7513",

"tx_date": "2020-12-02",

"amount": 10000.0000,

"total_inquiry": 10,

"paid_at": null,

"invoice_status": "UNPAID",

"due_at": "2020-12-03T16:59:59"

}, {

"invoice_id": "53f48b8a-1f53-4f56-aa91-7b32414a7513",

"tx_date": "2020-12-01",

"amount": 10000.0000,

"total_inquiry": 10,

"paid_at": "2020-12-02T08:00:00",

"invoice_status": "PAID",

"due_at": "2020-12-02T16:59:59"

}

]

}

Use this API to get inquiry invoices.

[Production] GET https://partner.oyindonesia.com/api/account-inquiry/invoices?offset=<offset>&limit=<limit>&status=<status>

[Staging] GET https://api-stg.oyindonesia.com/api/account-inquiry/invoices?offset=<offset>&limit=<limit>&status=<status>

| Parameter | Type | Required | Default | Description |

|---|---|---|---|---|

| offset | Integer | FALSE | 0 | start offset, default is 0, if empty will used default value |

| limit | Integer | FALSE | 10 | max item to fetch, default is 10, if empty will used default value |

| status | String | FALSE | invoice status to fetch. If empty will fetch invoice regardless of the status |

| Parameter | Type | Description |

|---|---|---|

| total | Integer | Total number of invoices per username |

| status | Object | Status of inquiry {code: <status_code>, message: <status_message>} |

| timestamp | Timestamp | UTC Timestamp api hit (Format: yyyy-MM-ddTHH:mm:ss) |

| data | Array of objects | List of objects {"invoice_id": <invoice_id>, "tx_date": <tx_date>, "amount": <amount>,"total_inquiry": <total_inquiry>, "paid_at": <paid-at>,"invoice_status": <invoice-status>,"due_at": <due-date>} - invoice_id invoice ID - tx_date the UTC+7 date of inquiry transaction from 00:00 UTC+7 until 23:59 UTC+7 - amount amount of the invoice- total_inquiry the number of inquiries- paid_at UTC invoice payment timestamp- invoice_status status of the invoice: INITIATED, UNPAID, or PAID- due_at UTC due timestamp for the invoice |

curl -X \

GET https://partner.oyindonesia.com/api/account-inquiry/invoices/e972bfcb-fcc4-4732-8887-91a589a0b54a \

-H 'content-type: application/json' \

-H 'accept: application/json' \

-H 'x-oy-username:myuser' \

-H 'x-api-key:987654'

The above command returns JSON structured similar like this:

{

"status": {

"code": "000",

"message": "Success"

},

"invoice_id": "e972bfcb-fcc4-4732-8887-91a589a0b54a",

"tx_date": "2020-12-03",

"amount": 2000.0000,

"total_inquiry": 2,

"paid_at": null,

"invoice_status": "INITIATED",

"due_at": "2020-12-04T16:59:59",

"timestamp": "2020-12-03T17:01:17"

}

Use this API to get inquiry invoice by ID.

[Production] GET https://partner.oyindonesia.com/api/account-inquiry/invoices/<id>

[Staging] GET https://api-stg.oyindonesia.com/api/account-inquiry/invoices/<id>

| Parameter | Type | Required | Default | Description |

|---|---|---|---|---|

| id | String | TRUE | Invoice ID |

| Parameter | Type | Description |

|---|---|---|

| status | Object | Status of inquiry {code: <status_code>, message: <status_message>} |

| invoice_id | String | invoice ID |

| tx_date | String | the UTC+7 date of inquiry transaction from 00:00 UTC+7 until 23:59 UTC+7 |

| amount | String | amount of the invoice |

| total_inquiry | Integer | the number of inquiries |

| paid_at | String | UTC invoice payment timestamp |

| invoice_status | String | status of the invoice: INITIATED, UNPAID, or PAID |

| due_at | String | UTC due timestamp for the invoice |

curl -X \

GET https://partner.oyindonesia.com/api/account-inquiry/invoices/pay \

-H 'content-type: application/json' \

-H 'accept: application/json' \

-H 'x-oy-username:myuser' \

-H 'x-api-key:987654' \

-d '{

"invoice_id": "53f48b8a-1f53-4f56-aa91-7b32414a7513"

}'

The above command returns JSON structured similar like this:

{

"status": {

"code": "000",

"message": "Success"

},

"invoice_id": "53f48b8a-1f53-4f56-aa91-7b32414a7513",

"tx_date": "2020-12-02",

"amount": 10000.0000,

"total_inquiry": 10,

"paid_at": "2020-12-03T01:01:18",

"invoice_status": "PAID",

"due_at": "2020-12-03T17:01:00",

"timestamp": "2020-12-03T01:01:17"

}

Use this API to pay inquiry invoice.

[Production] POST https://partner.oyindonesia.com/api/account-inquiry/invoices/pay

[Staging] POST https://api-stg.oyindonesia.com/api/account-inquiry/invoices/pay

| Parameter | Type | Required | Default | Description |

|---|---|---|---|---|

| invoice_id | String | TRUE | Invoice ID |

| Parameter | Type | Description |

|---|---|---|

| status | Object | Status of inquiry {code: <status_code>, message: <status_message>} |

| invoice_id | String | invoice ID |

| tx_date | String | the UTC+7 date of inquiry transaction from 00:00 UTC+7 until 23:59 UTC+7 |

| amount | String | amount of the invoice |

| total_inquiry | Integer | the number of inquiries |

| paid_at | String | UTC invoice payment timestamp |

| invoice_status | String | status of the invoice: INITIATED, UNPAID, or PAID |

| due_at | String | UTC due timestamp for the invoice |

These are the list of possible status codes for account inquiry:

| Status | Meaning |

|---|---|

| 000 | Inquiry is success |

| 201 | Request is Rejected (User ID is not Found) |

| 202 | Request is Rejected (User ID/product is not active) |

| 203 | Request is Rejected (User Config is not valid) |

| 204 | Request is Rejected (Invoice ID is not found) |

| 205 | Request is Rejected (Beneficiary Bank Code is Not Supported) |

| 206 | Failed doing payment (Balance is not enough) |

| 207 | Request is Rejected (Request IP Address is not Registered) |

| 208 | Request is Rejected (API Key is not Valid) |

| 209 | Request is Rejected (Bank Account is not found) |

| 232 | Request is Rejected (User has unpaid invoices) |

| 300 | Failed doing payment (Invoice is not on UNPAID status) |

| 429 | Request Rejected (Too Many Request to specific endpoint) |

| 990 | Request is Rejected (Request Parameter is not Valid) |

| 999 | Internal server error |

Disbursement APIs allow you to send fund to any bank accounts in Indonesia easily and real-time.

curl -X \

POST https://partner.oyindonesia.com/api/remit \

-H 'content-type: application/json' \

-H 'accept: application/json' \

-H 'x-oy-username:myuser' \

-H 'x-api-key:987654' \

-d '{

"recipient_bank": "014",

"recipient_account": "1239812390",

"amount":125000,

"note":"Split lunch bill",

"partner_trx_id":"1234-asdf",

"email" :"napoleon@email.com test@email.com",

"sender_info": {

"sender_account_name": "John Doe",

"sender_account_number": "12341235",

"sender_bank_code": "014"

},

"additional_data": {

"partner_merchant_id": "merchant_abcd123"

}

}'

var headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-oy-username': '{{username}}',

'x-api-key': '{{api-key}}'

};

var request = http.Request('POST', Uri.parse('{{base_url}}/api/remit'));

request.body = json.encode({

"recipient_bank": "008",

"recipient_account": "0201245681",

"amount": 15000,

"note": "Test API Disburse",

"partner_trx_id": "OYON0000064",

"email": "business.support@oyindonesia.com",

"sender_info": {

"sender_account_name": "John Doe",

"sender_account_number": "12341235",

"sender_bank_code": "014"

},

"additional_data": {

"partner_merchant_id": "merchant_abcd123"

}

});

request.headers.addAll(headers);

http.StreamedResponse response = await request.send();

if (response.statusCode == 200) {

print(await response.stream.bytesToString());

}

else {

print(response.reasonPhrase);

}

package main

import (

"fmt"

"strings"

"net/http"

"io/ioutil"

)

func main() {

url := "%7B%7Bbase_url%7D%7D/api/remit"

method := "POST"

payload := strings.NewReader(`{

"recipient_bank": "008",

"recipient_account": "0201245681",

"amount": 15000,

"note": "Test API Disburse",

"partner_trx_id": "OYON0000064",

"email": "business.support@oyindonesia.com",

"sender_info": {

"sender_account_name": "John Doe",

"sender_account_number": "12341235",

"sender_bank_code": "014"

},

"additional_data": {

"partner_merchant_id": "merchant_abcd123"

}

}`)

client := &http.Client {

}

req, err := http.NewRequest(method, url, payload)

if err != nil {

fmt.Println(err)

return

}

req.Header.Add("Content-Type", "application/json")

req.Header.Add("Accept", "application/json")

req.Header.Add("x-oy-username", "{{username}}")

req.Header.Add("x-api-key", "{{api-key}}")

res, err := client.Do(req)

if err != nil {

fmt.Println(err)

return

}

defer res.Body.Close()

body, err := ioutil.ReadAll(res.Body)

if err != nil {

fmt.Println(err)

return

}

fmt.Println(string(body))

}

OkHttpClient client = new OkHttpClient().newBuilder()

.build();

MediaType mediaType = MediaType.parse("application/json");

RequestBody body = RequestBody.create(mediaType, "{\n\t\"recipient_bank\": \"008\",\n\t\"recipient_account\": \"0201245681\",\n\t\"amount\": 15000,\n\t\"note\": \"Test API Disburse\",\n\t\"partner_trx_id\": \"OYON0000064\",\n\t\"email\": \"business.support@oyindonesia.com\",\n \"additional_data\": {\n \"partner_merchant_id\": \"merchant_abcd123\"\n }\n}");

Request request = new Request.Builder()

.url("{{base_url}}/api/remit")

.method("POST", body)

.addHeader("Content-Type", "application/json")

.addHeader("Accept", "application/json")

.addHeader("x-oy-username", "{{username}}")

.addHeader("x-api-key", "{{api-key}}")

.build();

Response response = client.newCall(request).execute();

var data = JSON.stringify({

"recipient_bank": "008",

"recipient_account": "0201245681",

"amount": 15000,

"note": "Test API Disburse",

"partner_trx_id": "OYON0000064",

"email": "business.support@oyindonesia.com",

"sender_info": {

"sender_account_name": "John Doe",

"sender_account_number": "12341235",

"sender_bank_code": "014"

},

"additional_data": {

"partner_merchant_id": "merchant_abcd123"

}

});

var xhr = new XMLHttpRequest();

xhr.withCredentials = true;

xhr.addEventListener("readystatechange", function() {

if(this.readyState === 4) {

console.log(this.responseText);

}

});

xhr.open("POST", "%7B%7Bbase_url%7D%7D/api/remit");

xhr.setRequestHeader("Content-Type", "application/json");

xhr.setRequestHeader("Accept", "application/json");

xhr.setRequestHeader("x-oy-username", "{{username}}");

xhr.setRequestHeader("x-api-key", "{{api-key}}");

xhr.send(data);

<?php

require_once 'HTTP/Request2.php';

$request = new HTTP_Request2();

$request->setUrl('{{base_url}}/api/remit');

$request->setMethod(HTTP_Request2::METHOD_POST);

$request->setConfig(array(

'follow_redirects' => TRUE

));

$request->setHeader(array(

'Content-Type' => 'application/json',

'Accept' => 'application/json',

'x-oy-username' => '{{username}}',

'x-api-key' => '{{api-key}}'

));

$request->setBody('{\n\t\"recipient_bank\": \"008\",\n\t\"recipient_account\": \"0201245681\",\n\t\"amount\": 15000,\n\t\"note\": \"Test API Disburse\",\n\t\"partner_trx_id\": \"OYON0000064\",\n\t\"email\": \"business.support@oyindonesia.com\",\n\t\"sender_info\": {\n\t\t\"sender_account_name\": \"John Doe\",\n\t\t\"sender_account_number\": \"12341235\",\n\t\t\"sender_bank_code\": \"014\"\n\t},\n\t\"additional_data\": {\n\t\t\"partner_merchant_id\": \"merchant_abcd123\"\n\t}\n}');

try {

$response = $request->send();

if ($response->getStatus() == 200) {

echo $response->getBody();

}

else {

echo 'Unexpected HTTP status: ' . $response->getStatus() . ' ' .

$response->getReasonPhrase();

}

}

catch(HTTP_Request2_Exception $e) {

echo 'Error: ' . $e->getMessage();

}

import http.client

import json

conn = http.client.HTTPSConnection("{{base_url}}")

payload = json.dumps({

"recipient_bank": "008",

"recipient_account": "0201245681",

"amount": 15000,

"note": "Test API Disburse",

"partner_trx_id": "OYON0000064",

"email": "business.support@oyindonesia.com",

"sender_info": {

"sender_account_name": "John Doe",

"sender_account_number": "12341235",

"sender_bank_code": "014"

},

"additional_data": {

"partner_merchant_id": "merchant_abcd123"

}

})

headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-oy-username': '{{username}}',

'x-api-key': '{{api-key}}'

}

conn.request("POST", "/api/remit", payload, headers)

res = conn.getresponse()

data = res.read()

print(data.decode("utf-8"))

Response for valid request (transaction will processed in the OY! system):

{

"status": {

"code": "101",

"message": "Request is Processed"

},

"amount": 10000,

"recipient_bank": "014",

"recipient_account": "12341234",

"trx_id": "d23ed68a-2a31-43a8-ac6f-15c0b45565c9",

"partner_trx_id": "TRX-20231211-007",

"timestamp": "11-12-2023 05:06:16"

}

Response for invalid request (transaction will rejected & not processed in the OY! system):

{

"status": {

"code": "264",

"message": "The suggested routing from the client is not valid"

},

"amount": 10000,

"recipient_bank": "014",

"recipient_account": "12341234",

"trx_id": "",

"partner_trx_id": "TRX-20231211-007",

"timestamp": "11-12-2023 05:06:16"

}

Use this API to start disbursing money to a specific beneficiary account.

[Production] POST https://partner.oyindonesia.com/api/remit

[Staging] POST https://api-stg.oyindonesia.com/api/remit

| Parameter | Type | Required | Description |

|---|---|---|---|

| recipient_bank | String(255) | TRUE | Please refer to the Disbursement Bank Codes to find the bank code for the recipient's bank account. |

| recipient_account | String(255) | TRUE | Recipient bank account number, numeric only. |

| amount | BigInteger | TRUE | Amount of disbursement, the minimum amount for bank is Rp10.000 and e-wallet is Rp100. |

| note | String(255) | FALSE | The transaction's message may or may not be reflected in the recipient's bank account statement, based on the bank's capabilities. Using alphanumeric characters and some common symbols (e.g. -, *, . ) |

| partner_trx_id | String(255) | TRUE | Unique disbursement ID for a specific request, generated by partner. |

| String(255) | FALSE | Multiple emails allowed, max. 5, separated by space. E.g. john.doe@example.com budi@example.com stark@example.com | |

| child_balance | String(255) | FALSE | If the Multi Account Management configuration is active, the disbursement will use the balance of child (sub-entity) account. Otherwise, the partner's own balance will be used by default. |

| sender_info | Object | FALSE | Object related to sender information. This object contain : • sender_account_name String(255) • sender_account_number String(255) • sender_bank_code String(255) By default, if your request does not include the sender_info object, the system will automatically use your registered bank account from Accounts > Bank Accounts. |

| additional_data | Object | FALSE | Object that includes the additional parameter for partner’s needs. This object contain partner_merchant_id String(64) (Unique ID for each of partner’s merchant) |

| Parameter | Type | Description |

|---|---|---|

| status | Object | Status of Disbursement in Object {code: <status_code>, message: <status_message>} |

| amount | BigInteger | Amount to disburse. |

| recipient_bank | String(255) | Bank or Ewallet code of the recipient’s account, please refer to Disbursement Bank Codes |

| recipient_account | String(255) | Recipient bank account number. |

| trx_id | String(36) | Unique disbursement ID from OY!, partners can use this ID for reconciliation. |

| partner_trx_id | String(255) | Unique disbursement ID which partner put on the request. |

| timestamp | String(19) | Creation time of disbursement transaction in OY! system, using the format "dd-mm-yyyy hh:mm:ss" in UTC time. |

Below is the list of response codes that show the request status for API Create Disbursement:

| Response Code | State | State Details | Description |

|---|---|---|---|

| 101 | Non-Final | Transaction In Progress | Transaction is processed. |

| 201 | Final | Transaction Not Created | Request is Rejected (User ID is not Found) |

| 202 | Final | Transaction Not Created | Request is Rejected (User ID is not Active) |

| 203 | Final | Transaction Not Created | Request is Rejected (Duplicate Partner Tx ID) |

| 205 | Final | Transaction Not Created | Request is Rejected (Beneficiary Bank Code is Not Supported) |

| 207 | Final | Transaction Not Created | Request is Rejected (Request IP Address is not Registered) |

| 208 | Final | Transaction Not Created | Request is Rejected (API Key is not Valid) |

| 209 | Final | Transaction Not Created | Request is Rejected (Bank Account is not found) |

| 210 | Final | Transaction Not Created | Request is Rejected (Amount is not valid) |

| 211 | Final | Transaction Not Created | Request is Rejected (Bank Account is not Allowed) |

| 257 | Final | Transaction Not Created | Request is Rejected (Disbursement with the same Partner Tx ID is still in process) |

| 264 | Final | Transaction Not Created | Request is rejected (The suggested routing from the partner is not valid) |

| 300 | Final | Transaction Failed | Transaction is failed. |

| 301 | Non-Final | Transaction Pending | Pending (when there is an unclear answer from bank network) |

| 429 | Final | Transaction Not Created | Request Rejected (Too Many Request to specific endpoint) |

| 504 | Non-Final | Transaction Unknown | Disbursement Submission Timed Out. Note: the transaction status is uncertain, it may or may not have been successfully submitted, so we suggest resubmitting using the same partner_trx_id. Please check your dashboard or contact our business representative. |

| 990 | Final | Transaction Not Created | Request is Rejected (Invalid Format) |

| 999 | Non-Final | Transaction Unknown | Internal Server Error. Please check your dashboard or contact our business representative |

Below is the list of Explanation for column state details that show on response code API Create Disbursement:

| State Details | Description |

|---|---|

| Transaction Failed | Transaction is failed to disburse. |

| Transaction In Progress | Transaction is still in progress. |

| Transaction Pending | Transaction has an unclear status from the banks. |

| Transaction Unknown | Transaction status is uncertain, please wait the callback or hit check status API to make sure the status of transaction. Please check to your dashboard or contact our business representative. |

| Transaction Not Created | Transaction is not created in the OY! system due to not valid disbursement request. |

Response for successful callback:

{

"status": {

"code": "000",

"message": "Success"

},

"amount": 10000.0000,

"recipient_name": "John Doe",

"recipient_bank": "014",

"recipient_account": "12341234",

"trx_id": "d23ed68a-2a31-43a8-ac6f-15c0b45565c9",

"partner_trx_id": "TRX-20231211-007",

"timestamp": "11-12-2023 05:07:20",

"created_date": "11-12-2023 05:06:20",

"last_updated_date": "11-12-2023 05:07:00",

"receipt_url": "https://api.oyindonesia.com/api/receipt?partner_trx_id=TRX-20231211-007&trx_id=d23ed68a-2a31-43a8-ac6f-15c0b45565c9"

}

Response for failed callback:

{

"status": {

"code": "300",

"message": "Failed"

},

"tx_status_description": "Your transaction amount exceeds maximum routing limit. Please adjust the routing and try again",

"amount": 10000.0000,

"recipient_name": "John Doe",

"recipient_bank": "014",

"recipient_account": "12341234",

"trx_id": "d23ed68a-2a31-43a8-ac6f-15c0b45565c9",

"partner_trx_id": "TRX-20231211-007",

"timestamp": "11-12-2023 05:07:20",

"created_date": "11-12-2023 05:06:20",

"last_updated_date": "11-12-2023 05:07:00"

}

Once a disbursement request is finished, our system will make a callback status of that disbursement request to your system.

You can set your own callback URL in OY Business dashboard setting. You can Open “Settings” tab, choose “Developer Option”, Choose “Callback Configuration”, and Fill your callback URL in the API Disbursement field.

We also have a resend callback feature which you can read about here.

| Parameter | Type | Description |

|---|---|---|

| status | Object | Status of Disbursement in Object {code: <status_code>, message: <status_message>} |

| tx_status_description | String(255) | Additional information regarding status code, especially for Failed transactions, Force Credit transactions, and Queued transactions. For example: “Account is blocked. Please create a new transaction with a different recipient account number.” Note: This parameter will not appear in the response body for transactions with a Success status. |

| amount | BigDecimal | Amount to disburse. Note: The amount field uses BigDecimal to maintain financial precision. Decimal values (e.g. 10000.0000) may appear in Get Disbursement Status and Callback responses due to standardized internal processing. |

| recipient_name | String(255) | Account holder name of recipient bank account. |

| recipient_bank | String(255) | Bank or Ewallet code of the recipient’s account, please refer to Disbursement Bank Codes |

| recipient_account | String(255) | Recipient bank account number. |

| trx_id | String(36) | Unique disbursement ID from OY!, partners can use this ID for reconciliation. |

| partner_trx_id | String(255) | Unique disbursement ID which partner put on the request. |

| timestamp | String(19) | Time of API get disbursement status called by partner ("dd-MM-yyyy HH:mm:ss in UTC time zone"). |

| created_date | String(19) | Execution time of disbursement in OY! system ("dd-MM-yyyy HH:mm:ss in UTC time zone"). |

| last_updated_date | String(19) | Latest status change of a disbursement. Example from 'Pending' to 'Success' ("dd-MM-yyyy HH:mm:ss in UTC Time zone") |

| receipt_url | String(255) | URL to download the transaction receipt. Contact our business representative to activate this parameter. |

Below is the list of response codes that show the transaction status for Disbursement Callback:

| Response Code | State | Description |

|---|---|---|

| 000 | Final | Transaction has been completed (success) |

| 300 | Final | Transaction is FAILED |

| 301 | Non-Final | Pending (When there is an unclear answer from Banks Network) |

curl -X \

POST https://partner.oyindonesia.com/api/remit-status \

-H 'content-type: application/json' \

-H 'accept: application/json' \

-H 'x-oy-username:myuser' \

-H 'x-api-key:987654' \

-d '{

"partner_trx_id": "1234-asde",

"send_callback": "true"

}'

var headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-oy-username': '{{username}}',

'x-api-key': '{{api-key}}'

};

var request = http.Request('POST', Uri.parse('{{base_url}}/api/remit-status'));

request.body = json.encode({

"partner_trx_id": "OYON0000056"

});

request.headers.addAll(headers);

http.StreamedResponse response = await request.send();

if (response.statusCode == 200) {

print(await response.stream.bytesToString());

}

else {

print(response.reasonPhrase);

}

package main

import (

"fmt"

"strings"

"net/http"

"io/ioutil"

)

func main() {

url := "%7B%7Bbase_url%7D%7D/api/remit-status"

method := "POST"

payload := strings.NewReader(`{

"partner_trx_id": "OYON0000056"

}`)

client := &http.Client {

}

req, err := http.NewRequest(method, url, payload)

if err != nil {

fmt.Println(err)

return

}

req.Header.Add("Content-Type", "application/json")

req.Header.Add("Accept", "application/json")

req.Header.Add("x-oy-username", "{{username}}")

req.Header.Add("x-api-key", "{{api-key}}")

res, err := client.Do(req)

if err != nil {

fmt.Println(err)

return

}

defer res.Body.Close()

body, err := ioutil.ReadAll(res.Body)

if err != nil {

fmt.Println(err)

return

}

fmt.Println(string(body))

}

OkHttpClient client = new OkHttpClient().newBuilder()

.build();

MediaType mediaType = MediaType.parse("application/json");

RequestBody body = RequestBody.create(mediaType, "{\n\t\"partner_trx_id\": \"OYON0000056\"\n}");

Request request = new Request.Builder()

.url("{{base_url}}/api/remit-status")

.method("POST", body)

.addHeader("Content-Type", "application/json")

.addHeader("Accept", "application/json")

.addHeader("x-oy-username", "{{username}}")

.addHeader("x-api-key", "{{api-key}}")

.build();

Response response = client.newCall(request).execute();

var data = JSON.stringify({

"partner_trx_id": "OYON0000056"

});

var xhr = new XMLHttpRequest();

xhr.withCredentials = true;

xhr.addEventListener("readystatechange", function() {

if(this.readyState === 4) {

console.log(this.responseText);

}

});

xhr.open("POST", "%7B%7Bbase_url%7D%7D/api/remit-status");

xhr.setRequestHeader("Content-Type", "application/json");

xhr.setRequestHeader("Accept", "application/json");

xhr.setRequestHeader("x-oy-username", "{{username}}");

xhr.setRequestHeader("x-api-key", "{{api-key}}");

xhr.send(data);

<?php

require_once 'HTTP/Request2.php';

$request = new HTTP_Request2();

$request->setUrl('{{base_url}}/api/remit-status');

$request->setMethod(HTTP_Request2::METHOD_POST);

$request->setConfig(array(

'follow_redirects' => TRUE

));

$request->setHeader(array(

'Content-Type' => 'application/json',

'Accept' => 'application/json',

'x-oy-username' => '{{username}}',

'x-api-key' => '{{api-key}}'

));

$request->setBody('{\n "partner_trx_id": "OYON0000056"\n}');

try {

$response = $request->send();

if ($response->getStatus() == 200) {

echo $response->getBody();

}

else {

echo 'Unexpected HTTP status: ' . $response->getStatus() . ' ' .

$response->getReasonPhrase();

}

}

catch(HTTP_Request2_Exception $e) {

echo 'Error: ' . $e->getMessage();

}

import http.client

import json

conn = http.client.HTTPSConnection("{{base_url}}")

payload = json.dumps({

"partner_trx_id": "OYON0000056"

})

headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-oy-username': '{{username}}',

'x-api-key': '{{api-key}}'

}

conn.request("POST", "/api/remit-status", payload, headers)

res = conn.getresponse()

data = res.read()

print(data.decode("utf-8"))

Response for success transaction status:

{

"status":{

"code":"000",

"message":"Success"

},

"tx_status_description":"",

"amount":10000.0000,

"recipient_name":"John Doe",

"recipient_bank":"014",

"recipient_account":"12341234",

"trx_id": "d23ed68a-2a31-43a8-ac6f-15c0b45565c9",

"partner_trx_id": "TRX-20231211-007",

"timestamp": "11-12-2023 05:07:20",

"created_date": "11-12-2023 05:06:20",

"last_updated_date": "11-12-2023 05:07:00",

"receipt_url": "https://api.oyindonesia.com/api/receipt?partner_trx_id=TRX-20231211-007&trx_id=d23ed68a-2a31-43a8-ac6f-15c0b45565c9"

}

Response for failed transaction status:

{

"status":{

"code":"300",

"message":"Failed"

},

"tx_status_description":"Your transaction amount exceeds maximum routing limit. Please adjust the routing and try again",

"amount":10000.0000,

"recipient_name":"John Doe",

"recipient_bank":"014",

"recipient_account":"12341234",

"trx_id": "d23ed68a-2a31-43a8-ac6f-15c0b45565c9",

"partner_trx_id": "TRX-20231211-007",

"timestamp": "11-12-2023 05:07:20",

"created_date": "11-12-2023 05:06:20",

"last_updated_date": "11-12-2023 05:07:00"

}

To get status of a disbursement request, you can call this API. You may need to call this API few times until getting a final status (success/failed). We suggest to check the status after the remit API timed out or 60 seconds after the disbursement requested

This API offers an option to send you a callback status of the disbursement request to a specific URL. You can set your own callback URL in OY Business dashboard setting. You can Open “Settings” tab, choose “Developer Option”, Choose “Callback Configuration”, and Fill your callback URL in the API Disbursement field.

[Production] POST https://partner.oyindonesia.com/api/remit-status

[Staging] POST https://api-stg.oyindonesia.com/api/remit-status

| Parameter | Type | Required | Description |

|---|---|---|---|

| partner_trx_id | String(255) | TRUE | Unique Disbursement ID for a specific request, generated by partner |

| send_callback | Boolean | FALSE | A flag to indiciate if the status of the disbursement request need to be re-sent as a callback or not |

| Parameter | Type | Description |

|---|---|---|

| status | Object | Status of Disbursement in Object {code: <status_code>, message: <status_message>} |

| tx_status_description | String(255) | Additional information of status code, especially for failed status. E.g. Account is blocked. Please create a new transaction with a different recipient account number. |

| amount | BigDecimal | Amount to disburse. Note: The amount field uses BigDecimal to maintain financial precision. Decimal values (e.g. 10000.0000) may appear in Get Disbursement Status and Callback responses due to standardized internal processing. |

| recipient_name | String(255) | Account holder name of recipient bank account. |

| recipient_bank | String(255) | Bank or Ewallet code of the recipient’s account, please refer to Disbursement Bank Codes |

| recipient_account | String(255) | Recipient bank account number. |

| trx_id | String(36) | Unique disbursement ID from OY!, partners can use this ID for reconciliation. |

| partner_trx_id | String(255) | Unique disbursement ID which partner put on the request. |

| timestamp | String(19) | Time of API get disbursement status called by partner ("dd-MM-yyyy HH:mm:ss in UTC time zone"). |

| created_date | String(19) | Execution time of disbursement in OY! system ("dd-MM-yyyy HH:mm:ss in UTC time zone"). |

| last_updated_date | String(19) | Latest status change of a disbursement. Example from 'Pending' to 'Success' ("dd-MM-yyyy HH:mm:ss in UTC Time zone") |

| receipt_url | String(255) | URL to download the transaction receipt. Contact our business representative to activate this parameter. |

Below is the list of response codes that show the request status for API Get Disbursement Status:

| Response Code | State | State Details | Description |

|---|---|---|---|

| 000 | Final | Transaction Success | Transaction has been completed. |

| 101 | Non-Final | Transaction In Progress | Transaction is processed. |

| 102 | Non-Final | Transaction In Progress | Transaction is in progress. |

| 201 | Non-Final | Transaction Unknown | Request for Get Disbursement Status is rejected (user ID is not found) |

| 202 | Non-Final | Transaction Unknown | Request for Get Disbursement Status is rejected (user ID is not active) |

| 204 | Final | Transaction Not Created | Transaction do not exist (Partner Tx ID is Not Found) |

| 206 | Final | Transaction Failed | Transaction is failed (partner deposit balance is not enough) |

| 207 | Non-Final | Transaction Unknown | Request for Get Disbursement Status is rejected (request IP Address is not registered) |

| 208 | Non-Final | Transaction Unknown | Request for Get Disbursement Status is rejected (API key is not valid) |

| 225 | Final | Transaction Failed | Transaction is failed (Transaction amount exceeds the maximum limit) |

| 300 | Final | Transaction Failed | Transaction is failed. |

| 301 | Non-Final | Transaction Pending | Pending (when there is an unclear answer from bank network) |

| 429 | Non-Final | Transaction Unknown | Request for Get Disbursement Status is rejected (too many requests to specific endpoint) |

| 990 | Final | Transaction Unknown | Request for Get Disbursement Status is rejected (invalid format) |

| 999 | Non-Final | Transaction Unknown | Internal Server Error |

Below is the list of Explanation for column state details that show on response code API Get Disbursement Status:

| State Details | Description |

|---|---|

| Transaction Success | Transaction has been completed & successfully received on the recipient account |

| Transaction Failed | Transaction is failed to disburse. |

| Transaction In Progress | Transaction is still in progress. |

| Transaction Pending | Transaction has an unclear status from the banks. |

| Transaction Unknown | Transaction status is uncertain, please wait the callback or hit check status API to make sure the status of transaction. Please check to your dashboard or contact our business representative. |

| Transaction Not Created | Transaction is not created in the OY! system due to not valid disbursement request. |

Request body mock data in demo environment:

{

"recipient_bank": "014",

"recipient_account": "2100000",

"amount": 10000,

"note": "Test Expose Route",

"partner_trx_id": "TRX-20231211-007",

"email": "yono@oyindonesia.com"

}

Response body mock data in demo environment:

{

"status": {

"code": "210",

"message": "Request is Rejected (Amount is not valid)"

},

"amount": 10000,

"recipient_bank": "014",

"recipient_account": "2100000",

"trx_id": "",

"partner_trx_id": "TRX-20231211-007",

"timestamp": "11-12-2023 05:06:16"

}

You can replicate final error response codes based on the Response Code by filling in the recipient_account value using this format: <desired response code>0000. You can input 4 to 15 characters consisting only of the digit 0 at the end of the response code. Any value that doesn’t follow this format as default will be processed as a Successful transaction.

For example, if you want to get the "Request is Rejected (Amount is not valid)” error, you can trigger the response code “210” by formatting the recipient_account as "2100000".

To test out all scenarios of API Disbursement and ensure the flows in your integration are handled correctly, please visit this link.

If you receive a failed disbursement in the callback or check status response, this means that we tried processing the disbursement and failed.

We return failed reasons description in our callback & check status response in the tx_status_description parameter. Partners need to understand each failed reason to decide the appropriate action to take. Below is a list of the failed reasons that partners may receive:

| Failed Reason | Explanation | Should I retry? |

|---|---|---|

| Account is blocked. Please create a new transaction with a different recipient account number. | Recipient account number is blocked by the bank & disbursement cannot proceed to this account. | If you retry with the same request, most likely it will return the same response. Please confirm to the recipient that the account number details are correct and can receive funds. After that, you can revise the request to the correct account number before trying again. |

| Account has exceeded the maximum amount for receiving money. Please contact the account owner. | Recipient account number has reached the balance limit amount that is set by the corresponding bank/e-wallet. | If you retry with the same request, most likely it will return the same response. Please confirm to the recipient that the account number details can receive funds for that amount. After that, you can revise the request to the correct account number and amount before trying again. |

| Account is no longer active. Please create a new transaction with a different recipient account number. | Recipient account number is no longer active in the bank & disbursement cannot proceed to this account. | If you retry with the same request, most likely it will return the same response. Please confirm to the recipient that the account number details are correct and can receive funds. After that, you can revise the request to the correct account number before trying again. |

| Account not found. Please create a new transaction with a different recipient account number. | Recipient account number is not found for the bank selected & disbursement cannot proceed to this account. | If you retry with the same request, most likely it will return the same response. Please confirm to the recipient that the account number details and the selected bank are correct and can receive funds. After that, you can revise the request to the correct account number before trying again. |

| The bank/e-wallet provider system is under maintenance. Please try again in a moment. | The bank/e-wallet is in downtime so there will be disturbances in the disbursement process. | Please ensure the information of the bank maintenance schedule to our customer service. If there is any clear information about the maintenance schedule from the banks, you can retry the transaction after the maintenance schedule is over. |

| The bank/e-wallet system encounters an error while disbursing the money. Try again in a moment. | The bank/e-wallet has an issue in their system to process the disbursement. There may be intermittent issues in the bank system that are unpredictable. | You can retry the disbursement in the next few minutes. If you need any further information regarding the issue, you can contact our customer service. |

| System encounters an error while disbursing the money. Please try again in a moment. | There is an issue in the process of the disbursement. There may be intermittent issues that are unpredictable. | You can retry the disbursement in the next few minutes. If you need any further information regarding the issue, you can contact our customer service. |

| Your transaction exceeds the maximum limit amount. Please adjust the amount and try again. | The transaction has an amount that exceeds the maximum limit that is already set in the OY! system. | If you retry with the same request, it will return the same response. Please adjust the transaction amount according to the maximum limit that OY! gives to you. If you need any further information regarding the limit amount, you can contact our business representative. |

| Not enough balance to disburse the money, please top up your balance. | Insufficient partner’s deposit balance to process the disbursement transaction. | Please top up your deposit balance in the OY! dashboard. You can retry the disbursement transaction after ensuring that you have sufficient balance in your account. |

curl -X \

GET https://partner.oyindonesia.com/api/balance \

-H 'Content-Type: application/json' \

-H 'Accept: application/json' \

-H 'X-OY-Username: janedoe' \

-H 'X-Api-Key: 7654321'

var headers = {

'x-oy-username': '{{username}}',

'x-api-key': '{{api-key}}',

'Content-Type': 'application/json',

'Accept': 'application/json'

};

var request = http.Request('GET', Uri.parse('{{base_url}}/api/balance'));

request.headers.addAll(headers);

http.StreamedResponse response = await request.send();

if (response.statusCode == 200) {

print(await response.stream.bytesToString());

}

else {

print(response.reasonPhrase);

}

package main

import (

"fmt"

"net/http"

"io/ioutil"

)

func main() {

url := "%7B%7Bbase_url%7D%7D/api/balance"

method := "GET"

client := &http.Client {

}

req, err := http.NewRequest(method, url, nil)

if err != nil {

fmt.Println(err)

return

}

req.Header.Add("x-oy-username", "{{username}}")

req.Header.Add("x-api-key", "{{api-key}}")

req.Header.Add("Content-Type", "application/json")

req.Header.Add("Accept", "application/json")

res, err := client.Do(req)

if err != nil {

fmt.Println(err)

return

}

defer res.Body.Close()

body, err := ioutil.ReadAll(res.Body)

if err != nil {

fmt.Println(err)

return

}

fmt.Println(string(body))

}

OkHttpClient client = new OkHttpClient().newBuilder()

.build();

Request request = new Request.Builder()

.url("{{base_url}}/api/balance")

.method("GET", null)

.addHeader("x-oy-username", "{{username}}")

.addHeader("x-api-key", "{{api-key}}")

.addHeader("Content-Type", "application/json")

.addHeader("Accept", "application/json")

.build();

Response response = client.newCall(request).execute();

var xhr = new XMLHttpRequest();

xhr.withCredentials = true;

xhr.addEventListener("readystatechange", function() {

if(this.readyState === 4) {

console.log(this.responseText);

}

});

xhr.open("GET", "%7B%7Bbase_url%7D%7D/api/balance");

xhr.setRequestHeader("x-oy-username", "{{username}}");

xhr.setRequestHeader("x-api-key", "{{api-key}}");

xhr.setRequestHeader("Content-Type", "application/json");

xhr.setRequestHeader("Accept", "application/json");

xhr.send();

<?php

require_once 'HTTP/Request2.php';

$request = new HTTP_Request2();

$request->setUrl('{{base_url}}/api/balance');

$request->setMethod(HTTP_Request2::METHOD_GET);

$request->setConfig(array(

'follow_redirects' => TRUE

));

$request->setHeader(array(

'x-oy-username' => '{{username}}',

'x-api-key' => '{{api-key}}',

'Content-Type' => 'application/json',

'Accept' => 'application/json'

));

try {

$response = $request->send();

if ($response->getStatus() == 200) {

echo $response->getBody();

}

else {

echo 'Unexpected HTTP status: ' . $response->getStatus() . ' ' .

$response->getReasonPhrase();

}

}

catch(HTTP_Request2_Exception $e) {

echo 'Error: ' . $e->getMessage();

}

import http.client

import json

conn = http.client.HTTPSConnection("{{base_url}}")

payload = ''

headers = {

'x-oy-username': '{{username}}',

'x-api-key': '{{api-key}}',

'Content-Type': 'application/json',

'Accept': 'application/json'

}

conn.request("GET", "/api/balance", payload, headers)

res = conn.getresponse()

data = res.read()

print(data.decode("utf-8"))

The above command returns JSON structured similar like this:

{

"status":{

"code":"000",

"message":"Success"

},

"balance":100000000.0000,

"overdraftBalance":500000.0000,

"overbookingBalance":200000.0000,

"pendingBalance":2000000.0000,

"availableBalance":98500000.0000,

"timestamp":"10-12-2019 12:15:37"

}

Use this API to get partner balance.

[Production] GET https://partner.oyindonesia.com/api/balance

[Staging] GET https://api-stg.oyindonesia.com/api/balance

| Parameter | Type | Description |

|---|---|---|

| status | Object | Status of Disbursement in Object {code: <status_code>, message: <status_message>} |

| balance | BigDecimal | Remaining balance (Accept non fraction number) |

| overdraftBalance | BigDecimal | Remaining overdraft balance (Accept non fraction number) |

| overbookingBalance | BigDecimal | Remaining overbooking balance (Accept non fraction number) |

| pendingBalance | BigDecimal | The cumulative balance of your pending transactions. |

| availableBalance | BigDecimal | The total cumulative money of Balance + Available Overdraft - Pending Balance that you can use for disbursement. |

| timestamp | String(19) | Execution time of Disbursement in OY! system ("dd-MM-yyyy HH:mm:ss in UTC Time zone"). |

Below is the list of response codes that show the request status for API Get Balance:

| Response Code | Description | Notes |

|---|---|---|

| 000 | Request get balance is success | - |

| 207 | Request is Rejected (Request IP Address is not Registered) | Request check balance rejected. |

| 208 | Request is Rejected (API Key is not Valid) | Request check balance rejected. |

| 999 | Internal Server Error | Request check balance rejected. |

| 201 | Request is Rejected (User ID is not Found) | Request check balance rejected. |

| 202 | Request is Rejected (User ID is not Active) | Request check balance rejected. |

| 429 | Request Rejected (Too Many Request to specific endpoint) | Request check balance rejected. |

| 900 | Request is Rejected (Invalid Format) | Request check balance rejected. |

Supported Bank Codes to be used in the Disbursement Request:

| Bank Codes | Bank Name |

|---|---|

| 002 | BRI |

| 008 | Bank Mandiri |

| 009 | Bank Negara Indonesia |

| 011 | Bank Danamon |

| 013 | Bank Permata |

| 014 | BCA |

| 016 | BII Maybank |

| 019 | Bank Panin |

| 022 | CIMB Niaga |

| 023 | Bank UOB Indonesia |

| 028 | Bank OCBC NISP |

| 031 | Citibank |

| 032 | JPMorgan Chase Bank |

| 036 | Bank China Construction Bank Indonesia |

| 037 | Bank Artha Graha Internasional |

| 042 | MUFG Bank |

| 046 | Bank DBS Indonesia |

| 050 | Standard Chartered |

| 054 | Bank Capital Indonesia |

| 061 | ANZ Indonesia |

| 067 | Deutsche Bank AG |

| 069 | Bank OF China |

| 076 | Bank Bumi Arta |

| 087 | Bank HSBC Indonesia |

| 088 | Bank Antardaerah |

| 089 | Bank Rabobank |

| 095 | Bank Jtrust Indonesia |

| 097 | Bank Mayapada International |

| 110 | BJB |

| 111 | Bank DKI |

| 112 | Bank DIY |

| 112S | Bank DIY Syariah |

| 113 | Bank Jateng |

| 114 | Bank Jatim |

| 114S | Bank Jatim Syariah |

| 115 | Bank Jambi |

| 115S | Bank Jambi Syariah |

| 116 | Bank Aceh |

| 117 | Bank Sumut |

| 117S | Bank Sumut Syariah |

| 118 | Bank Nagari |

| 118S | Bank Nagari Syariah |

| 119 | Bank Riau |

| 120 | Bank Sumsel Babel |

| 120S | Bank Sumsel Babel Syariah |

| 121 | Bank Lampung |

| 122 | Bank Kalsel |

| 122S | Bank Kalsel Syariah |

| 123 | Bank Kalbar |

| 123S | Bank Kalbar Syariah |

| 124 | Bank Kaltim |

| 124S | Bank Kaltim Syariah |

| 125 | Bank Kalteng |

| 126 | Bank Sulselbar |

| 126S | Bank Sulselbar Syariah |

| 127 | Bank Sulut |

| 128 | Bank NTB |

| 129 | Bank Bali |

| 130 | Bank NTT |

| 131 | Bank Maluku |

| 132 | Bank Papua |

| 133 | Bank Bengkulu |

| 134 | Bank Sulteng |

| 135 | Bank Sultra |

| 137 | Bank Banten |

| 145 | Bank Nusantara Parahyangan |

| 146 | Bank Of India Indonesia |

| 147 | Bank Muamalat |

| 151 | Bank Mestika |

| 152 | Bank Shinhan |

| 153 | Bank Sinarmas |

| 157 | Bank Maspion Indonesia |

| 161 | Bank Ganesha |

| 164 | Bank ICBC Indonesia |

| 167 | Bank QNB Indonesia |

| 200 | BTN |

| 200S | BTN Syariah |

| 212 | Bank Woori Saudara |

| 213 | Bank SMBC Indonesia |

| 405 | Bank Victoria Syariah |

| 425 | BJB Syariah |

| 426 | Bank Mega |

| 441 | Bank Bukopin |

| 451 | Bank Syariah Indonesia |

| 459 | Krom Bank Indonesia |

| 472 | Bank Jasa Jakarta |

| 484 | Bank KEB Hana |

| 485 | Bank MNC |

| 490 | Bank Neo Commerce |

| 494 | Bank Raya Indonesia |

| 498 | Bank SBI Indonesia |

| 501 | BCA Digital |

| 503 | Bank National Nobu |

| 506 | Bank Mega Syariah |

| 513 | Bank INA |

| 517 | Bank Panin Syariah |

| 520 | Bank Prima |

| 521 | Bank Syariah Bukopin |

| 523 | Bank Sahabat Sampoerna |

| 526 | Bank Oke Indonesia |

| 535 | Bank Seabank Indonesia |

| 536 | Bank BCA Syariah |

| 542 | Bank Jago |

| 542S | Bank Jago Syariah |

| 547 | Bank BTPN Syariah |

| 548 | Bank Multiarta Sentosa |

| 553 | Bank Hibank Indonesia |

| 555 | Bank Index |

| 559 | Bank CNB |

| 562 | Superbank |

| 564 | Bank Mandiri Taspen |

| 566 | Bank Victoria International |

| 567 | Allo Bank |

| 600 | ATMB LSB |

| 688 | BPR KS |

| 724 | Bank DKI Syariah |

| 725 | Bank Jateng Syariah |

| 734 | Bank Sinarmas Syariah |

| 777 | Finnet |

| 867 | Bank Eka |

| 945 | Bank IBK Indonesia |

| 949 | Bank CTBC Indonesia |

| 950 | Bank Commonwealth |

| 987 | ATMB Plus |

| dana | DANA |

| gopay | GoPay |

| linkaja | LinkAja |

| ovo | OVO |

| shopeepay | Shopeepay |

The International Transfer API allows you to seamlessly send cross-border payments to recipients in supported destination countries. It supports secure, compliant, and efficient international transfers for both personal and business recipients.

curl -X \

GET https://partner.oyindonesia.com/api/international/banks?destination_country_code=SG \

-H 'content-type: application/json' \

-H 'accept: application/json' \

-H 'x-oy-username:myuser' \

-H 'x-api-key:987654' \'

var headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-oy-username': '{{username}}',

'x-api-key': '{{api-key}}'

};

var request = http.Request('GET', Uri.parse('{{base_url}}/api/international/banks?destination_country_code=SG'));

request.headers.addAll(headers);

http.StreamedResponse response = await request.send();

if (response.statusCode == 200) {

print(await response.stream.bytesToString());

}

else {

print(response.reasonPhrase);

}

package main

import (

"fmt"

"strings"

"net/http"

"io/ioutil"

)

func main() {

url := "%7B%7Bbase_url%7D%7D/api/international/banks?destination_country_code=SG"

method := "GET"

client := &http.Client {

}

req, err := http.NewRequest(method, url)

if err != nil {

fmt.Println(err)

return

}

req.Header.Add("Content-Type", "application/json")

req.Header.Add("Accept", "application/json")

req.Header.Add("x-oy-username", "{{username}}")

req.Header.Add("x-api-key", "{{api-key}}")

res, err := client.Do(req)

if err != nil {

fmt.Println(err)

return

}

defer res.Body.Close()

body, err := ioutil.ReadAll(res.Body)

if err != nil {

fmt.Println(err)

return

}

fmt.Println(string(body))

}

OkHttpClient client = new OkHttpClient().newBuilder()

.build();

MediaType mediaType = MediaType.parse("application/json");

Request request = new Request.Builder()

.url("{{base_url}}/api/international/banks?destination_country_code=SG")

.method("GET", body)

.addHeader("Content-Type", "application/json")

.addHeader("Accept", "application/json")

.addHeader("x-oy-username", "{{username}}")

.addHeader("x-api-key", "{{api-key}}")

.build();

Response response = client.newCall(request).execute();

var xhr = new XMLHttpRequest();

xhr.withCredentials = true;

xhr.addEventListener("readystatechange", function () {

if (this.readyState === 4) {

console.log(this.responseText);

}

});

xhr.open("GET", "%7B%7Bbase_url%7D%7D/api/international/banks?destination_country_code=SG");

xhr.setRequestHeader("Content-Type", "application/json");

xhr.setRequestHeader("Accept", "application/json");

xhr.setRequestHeader("x-oy-username", "{{username}}");

xhr.setRequestHeader("x-api-key", "{{api-key}}");

xhr.send(data);

<?php

require_once 'HTTP/Request2.php';

$request = new HTTP_Request2();

$request->setUrl('{{base_url}}/api/international/banks?destination_country_code=SG');

$request->setMethod(HTTP_Request2::METHOD_GET);

$request->setConfig(array(

'follow_redirects' => TRUE

));

$request->setHeader(array(

'Content-Type' => 'application/json',

'Accept' => 'application/json',

'x-oy-username' => '{{username}}',

'x-api-key' => '{{api-key}}'

));

try {

$response = $request->send();

if ($response->getStatus() == 200) {

echo $response->getBody();

}

else {

echo 'Unexpected HTTP status: ' . $response->getStatus() . ' ' .

$response->getReasonPhrase();

}

}

catch(HTTP_Request2_Exception $e) {

echo 'Error: ' . $e->getMessage();

}

import http.client

import json

conn = http.client.HTTPSConnection("{{base_url}}")

headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-oy-username': '{{username}}',

'x-api-key': '{{api-key}}'

}

conn.request("GET", "/api/international/banks?destination_country_code=SG", payload, headers)

res = conn.getresponse()

data = res.read()

print(data.decode("utf-8"))

API Response for Valid Request (Request will be processed in the OY! system):

{

"status": {

"code": "000",

"message": "Success"

},

"banks": [

{

"bank_country": "SG",

"bank_details": [

{

"bank_name": "Oversea-Chinese Banking Corporation Limited [OCBC Bank]",

"bank_code": "TSSG0034"

},

{

"bank_name": "Svenska Handelsbanken, Singapore Branch",

"bank_code": "TSSG0043"

}

]

}

]

}

API Response for Invalid Request (Request will be rejected and not processed in the OY! system):

{

"status": {

"code": "990",

"message": "Destination Country Code is not valid"

},

"banks": null

}

This endpoint is used to get a list of available Destination Banks for International Transfer API transactions in all Destination Countries.

[Production] GET https://partner.oyindonesia.com/api/international/banks?destination_country_code=:destination_country_code

[Staging] GET https://api-stg.oyindonesia.com/api/international/banks?destination_country_code=:destination_country_code

| Parameter | Type | Required | Description |

|---|---|---|---|

| destination_country_code | String(2) | TRUE | Destination Country Code. Two-letter ISO 3166-2 country code. |

| Parameter | Type | Description |

|---|---|---|

| status | Object | Information about the result of the API request. It does not indicate the status of the transaction itself but rather confirms whether the request was successfully processed by the API. {code: <status_code>, message: <status_message>} See Response Codes & Messages for more details. |

| banks | Object | |

| bank_country | String | Destination Country Code. Two-letter ISO 3166-2 country code. |

| bank_details | Object | |

| bank_name | String | Bank Name |

| bank_code | String | Bank Code |

| HTTP Status | Case Code | Response Message | Description |

|---|---|---|---|

| 200 OK | 000 | Success | Request successful |

| 403 Forbidden | 201 | User is not found | Indicates that the x-oy-username Header is either missing from the request or is present but empty. It may also indicate that the provided x-oy-username value does not exist in the database. |

| 403 Forbidden | 202 | User is not active | Indicates that the x-oy-username Header contains a value with an inactive International Transfer API product. |

| 403 Forbidden | 207 | IP Address not registered | Indicates that the Client IP Address is not whitelisted in OY!. |

| 403 Forbidden | 208 | API Key is not valid | Indicates that the x-api-key Header is either missing from the request or is present but empty. It may also indicate that the provided x-api-key value does not match the one registered in OY!. |

| 400 Bad Request | 990 | Destination Country Code is required | Indicates that the destination_country_code parameter is missing from the request or contains an empty value. |

| 400 Bad Request | 990 | Destination Country Code is not valid | Indicates that the destination_country_code parameter does not match any valid ENUM value or contains an invalid value (e.g., OY). |

| 400 Bad Request | 990 | Destination Country Code must be 2 characters | Indicates that the destination_country_code parameter contains a value of less than or more than 2 characters. |

| 429 Too Many Requests | 429 | Too Many Requests | Indicates that the Client has sent too many requests within a given period, exceeding the allowed rate limit. |

| 504 Gateway Timeout | 504 | Request Timeout | Indicates that the server does not receive a timely response from an OY! Service. |

| 500 Server Error | 999 | Oops! Something went wrong! Sorry for the inconvenience. \n The application has encountered an unknown error. \n We have been automatically notified and will be looking into this with the utmost urgency. | Indicates failures due to an unexpected issue on the server side, including unhandled NPEs and database issues. |

curl -X \

GET https://partner.oyindonesia.com/api/international/active-corridors \

-H 'content-type: application/json' \

-H 'accept: application/json' \

-H 'x-oy-username:myuser' \

-H 'x-api-key:987654' \'

var headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-oy-username': '{{username}}',

'x-api-key': '{{api-key}}'

};

var request = http.Request('GET', Uri.parse('{{base_url}}/api/international/active-corridors'));

request.headers.addAll(headers);

http.StreamedResponse response = await request.send();

if (response.statusCode == 200) {

print(await response.stream.bytesToString());

}

else {

print(response.reasonPhrase);

}

package main

import (

"fmt"

"strings"

"net/http"

"io/ioutil"

)

func main() {

url := "%7B%7Bbase_url%7D%7D/api/international/active-corridors"

method := "GET"

client := &http.Client {

}

req, err := http.NewRequest(method, url)

if err != nil {

fmt.Println(err)

return

}

req.Header.Add("Content-Type", "application/json")

req.Header.Add("Accept", "application/json")

req.Header.Add("x-oy-username", "{{username}}")

req.Header.Add("x-api-key", "{{api-key}}")

res, err := client.Do(req)

if err != nil {

fmt.Println(err)

return

}

defer res.Body.Close()

body, err := ioutil.ReadAll(res.Body)

if err != nil {

fmt.Println(err)

return

}

fmt.Println(string(body))

}

OkHttpClient client = new OkHttpClient().newBuilder()

.build();

MediaType mediaType = MediaType.parse("application/json");

Request request = new Request.Builder()

.url("{{base_url}}/api/international/active-corridors")

.method("GET", body)

.addHeader("Content-Type", "application/json")

.addHeader("Accept", "application/json")

.addHeader("x-oy-username", "{{username}}")

.addHeader("x-api-key", "{{api-key}}")

.build();

Response response = client.newCall(request).execute();

var xhr = new XMLHttpRequest();

xhr.withCredentials = true;

xhr.addEventListener("readystatechange", function () {

if (this.readyState === 4) {

console.log(this.responseText);

}

});

xhr.open("GET", "%7B%7Bbase_url%7D%7D/api/international/active-corridors");

xhr.setRequestHeader("Content-Type", "application/json");

xhr.setRequestHeader("Accept", "application/json");

xhr.setRequestHeader("x-oy-username", "{{username}}");

xhr.setRequestHeader("x-api-key", "{{api-key}}");

xhr.send(data);

<?php

require_once 'HTTP/Request2.php';

$request = new HTTP_Request2();

$request->setUrl('{{base_url}}/api/international/active-corridors');

$request->setMethod(HTTP_Request2::METHOD_GET);

$request->setConfig(array(

'follow_redirects' => TRUE

));

$request->setHeader(array(

'Content-Type' => 'application/json',

'Accept' => 'application/json',

'x-oy-username' => '{{username}}',

'x-api-key' => '{{api-key}}'

));

try {

$response = $request->send();

if ($response->getStatus() == 200) {

echo $response->getBody();

}

else {

echo 'Unexpected HTTP status: ' . $response->getStatus() . ' ' .

$response->getReasonPhrase();

}

}

catch(HTTP_Request2_Exception $e) {

echo 'Error: ' . $e->getMessage();

}

import http.client

import json

conn = http.client.HTTPSConnection("{{base_url}}")

headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-oy-username': '{{username}}',

'x-api-key': '{{api-key}}'

}

conn.request("GET", "/api/international/active-corridors", payload, headers)

res = conn.getresponse()

data = res.read()

print(data.decode("utf-8"))

API Response for Valid Request (Request will be processed in the OY! system):

{

"status": {

"code": "000",

"message": "Success"

},

"active_corridors": [

{

"currency": {

"currency_code": "CNH",

"currency_name": "Chinese Yuan Offshore"

},

"country_list": [

{

"country_code": "CN",

"country_name": "China"

}

]

},

{

"currency": {

"currency_code": "HKD",

"currency_name": "Hong Kong Dollar"

},

"country_list": [

{

"country_code": "HK",

"country_name": "Hong Kong"

}

]

},

{

"currency": {

"currency_code": "SGD",

"currency_name": "Singapore Dollar"

},

"country_list": [

{

"country_code": "SG",

"country_name": "Singapore"

}

]

},

{

"currency": {

"currency_code": "USD",

"currency_name": "United States Dollar"

},

"country_list": [

{

"country_code": "CN",

"country_name": "China"

},

{

"country_code": "SG",

"country_name": "Singapore"

},

{

"country_code": "HK",

"country_name": "Hong Kong"

}

]

}

]

}

API Response for Invalid Request (Request will be rejected and not processed in the OY! system):

{

"status": {

"code": "208",

"message": "API Key is not valid"

},

"active_corridors": null

}

This endpoint is used to get the latest active corridor information in your account.

[Production] GET https://partner.oyindonesia.com/api/international/active-corridors

[Staging] GET https://api-stg.oyindonesia.com/api/international/active-corridors

| Parameter | Type | Description |

|---|---|---|

| status | Object | Information about the result of the API request. It does not indicate the status of the transaction itself but rather confirms whether the request was successfully processed by the API. {code: <status_code>, message: <status_message>} See Response Codes & Messages for more details. |

| active_corridors | Array | |

| currency | Object | |

| currency_code | String | Destination Currency Code. Three-letter ISO 4217 currency code. |

| currency_name | String | Description of Destination Currency Code |

| country_list | Object | |

| country_code | String | Destination Country Code. Two-letter ISO 3166-2 country code. |

| country_name | String | Description of Destination Country Code |

| HTTP Status | Case Code | Response Message | Description |

|---|---|---|---|

| 200 OK | 000 | Success | Request successful |

| 403 Forbidden | 201 | User is not found | Indicates that the x-oy-username Header is either missing from the request or is present but empty. It may also indicate that the provided x-oy-username value does not exist in the database. |

| 403 Forbidden | 202 | User is not active | Indicates that the x-oy-username Header contains a value with an inactive International Transfer API product. |

| 403 Forbidden | 207 | IP Address not registered | Indicates that the Client IP Address is not whitelisted in OY!. |

| 403 Forbidden | 208 | API Key is not valid | Indicates that the x-api-key Header is either missing from the request or is present but empty. It may also indicate that the provided x-api-key value does not match the one registered in OY!. |

| 429 Too Many Requests | 429 | Too Many Requests | Indicates that the Client has sent too many requests within a given period, exceeding the allowed rate limit. |

| 504 Gateway Timeout | 504 | Request Timeout | Indicates that the server does not receive a timely response from an OY! Service. |

| 500 Server Error | 999 | Oops! Something went wrong! Sorry for the inconvenience. \n The application has encountered an unknown error. \n We have been automatically notified and will be looking into this with the utmost urgency. | Indicates failures due to an unexpected issue on the server side, including unhandled NPEs and database issues. |

curl -X \

POST https://partner.oyindonesia.com/api/international/fx-rate \

-H 'content-type: application/json' \

-H 'accept: application/json' \

-H 'x-oy-username:myuser' \

-H 'x-api-key:987654' \

-d '{

"destination_country_code": "SG",

"destination_currency_code": "SGD",

"source_amount": 200000,

"destination_amount": ""

}'

var headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-oy-username': '{{username}}',

'x-api-key': '{{api-key}}'

};

var request = http.Request('POST', Uri.parse('{{base_url}}/api/international/fx-rate'));

request.body = json.encode({

"destination_country_code": "SG",